Choice is what stands between you and financial success. It is a simple word but so complex in its application.

If you have ever flown, you have experienced the Safety demonstration from a flight attendant.

Do you remember this?

“If you are traveling with a child or someone who requires assistance, secure your mask on first and then assist the other person.”

You must take care of yourself first. It is all about choice.

Choice

an act of selecting or making a decision when faced with two or more possibilities.

“The choice between good and evil”

That deciding part is the devil in the details.

One of my favorite sayings is not deciding is a decision or another way of looking at this is “paralysis by analysis”.

Dallasites with a $100,000 salary can expect about $38,307 a year after essential expenses such as housing, groceries and health care, according to an analysis from GoBankingRates. The personal finance company crunched numbers on how far that six-figure salary goes in 50 U.S. cities.

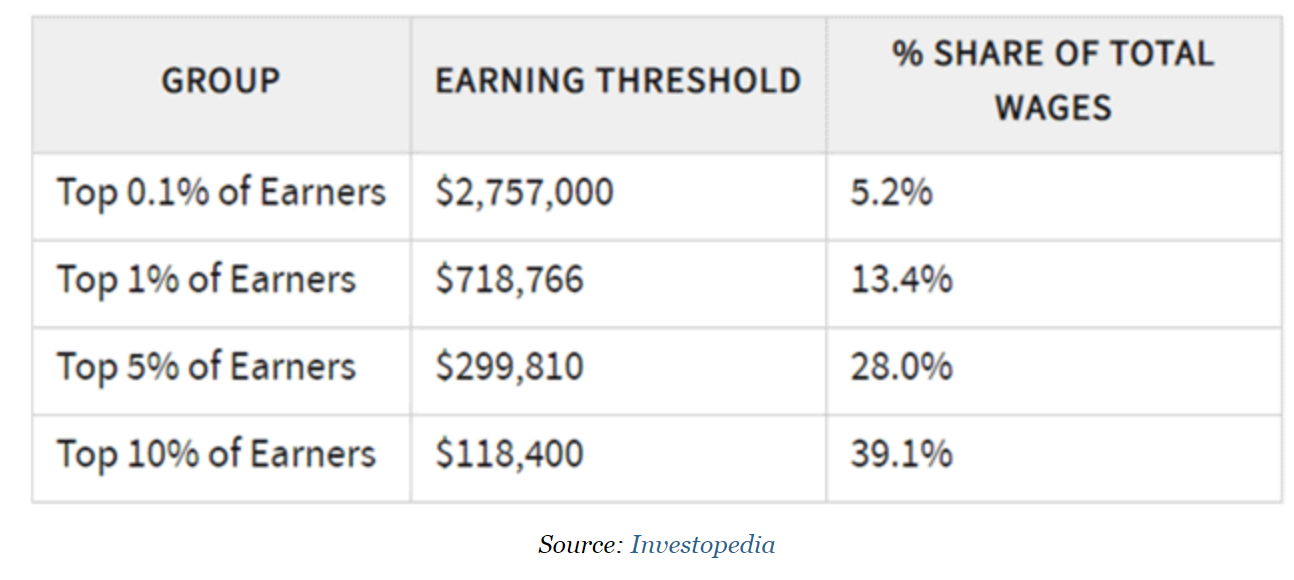

$100,000 used to be the golden number of success. Adjust it just a small amount and $118,000 puts you in the Top 10% of All Earners!

Then when why do I read about and work with people that are making money that puts them is not only the Top 10% but the Top 5% of earners and find that they are basically one paycheck away from being broke?

Choice – it is the most powerful word in our language.

When you fail to acknowledge your choices and ignore the cost of your choice you will find yourself on the treadmill to failure.

One of my favorite financial writers is Jared Dillion. You can find him on twitter @dailydirtnap. I admire his sarcastic sense of humor.

What I admire the most is his ongoing conversation about being a CF.

CF you say – yes, it is the nice way to say a Cheap F_____.

Today we are caught up in an incredible rat race to keep up with our peers. It is a net loss game. If you are not taking care of yourself first, you will lose. Taking care of yourself requires that you make choices that are not popular or easy.

CARS

The biggest choice I see people make mistakes is buying cars.

Take Jared’s Simple Rule that I advocate 100%

2/20/4

2 years old

20% down

Finance over 4 years or less.

A car is not an investment. It is a depreciating asset that loses 30% of its value in the first two years (Carfax)

Then there is the enticement of ZERO % interest for SEVEN YEARS.

IT IS A TRAP

After 4 years your new car has lost 50% or more of its value and If you are paying for it in seven years you are trapped.

Ask yourself this simple question.

Do you know what you are going to be doing in seven years?

The answer is NO.

Some days I am not sure what I did yesterday much less what I am going to be doing in seven years.

The key here is that while you may read this and understand it from a purely economic viewpoint when you see the “new car” your senses and your ability to make smart choices leave you faster than a college freshman’s logic on the first trip to the bar.

Nothing good is going to occur.

Before you ask, LEASING SUCKS. You are paying someone else for the privilege of borrowing their car and paying them for it until the lease is over. Then you must give it back and hope you don’t owe them more money.

Look at your financial life and ask yourself a simple question.

What does it take to be a CF?

It’s a tough answer.

Want someone to sort through your “stuff” and get you on the right step towards financial success and being a wealthy CF?

Give me a call 214-239-4700 or an email michael@tannerycompany.com

Together we can create a plan to change your course of financial success.

Loving the 60-degree mornings and knowing that August is coming,

Michael Tannery CPA CDFA® AIF® ● CEO

Registered Principal

michael@tannerycompany.com

Subscribe here to our weekly blog

Be A Financial Olympian™